The industry new service Intelligence OnLine reported on 21 December 2016:

During a visit to London in November, Malaysia’s deputy prime minister and interior minister Ahmad Zahid held a discreet meeting with Britain’s main defence industry players. BAE Systems and Airbus Group were told that the Malaysian government would not place an order for new fighter plans until the 1Malaysia Development Berhad (1MDB) affair had been resolved.

The meeting is reported to have been arranged by Grant Rogan of Blenheim Captial.

To be read with earlier post pasted below.

END

Tuesday, January 10, 2017

Typhoon fighter jets in exchange for silence on 1MDB:Has the UK cut a deal with Najib, brokered by the UK MOD's Grant Rogan?

by Gaaesh Sahathevan

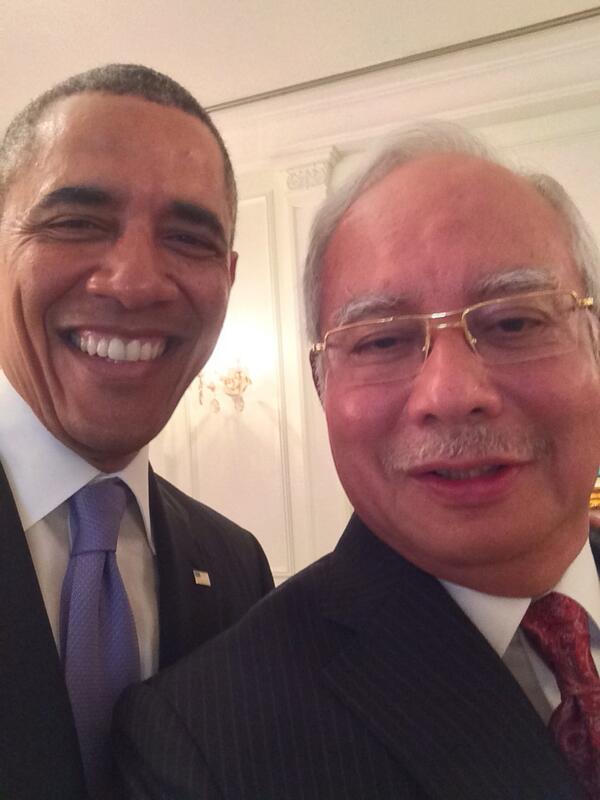

It appears that Malaysian PM Najib Razak's Government has decided that it will acquire British made Typhoon jets. It is understood that the deal involves the UK Government not acting on information it has on the 1MDB scandal.

As previously reported on a related blog, Najib and family, as well as other members of Malaysia's political elite, are subjects of the UK.s National Crime Agency attention with regards the 1MDB theft.

Rogan, with his team of ex-British defence ministry staff and defence industry executives, acts for groups like Dassault, BAE Systems, Airbus and Lockheed Martin.

DSA 2016: BAE Systems outlines Typhoon offset package for Malaysia

Jon Grevatt, Bangkok - IHS Jane's Defence Weekly

18 April 2016

It appears that Malaysian PM Najib Razak's Government has decided that it will acquire British made Typhoon jets. It is understood that the deal involves the UK Government not acting on information it has on the 1MDB scandal.

As previously reported on a related blog, Najib and family, as well as other members of Malaysia's political elite, are subjects of the UK.s National Crime Agency attention with regards the 1MDB theft.

The deal is likely to include an offsets component (see below) which is more than likely to have been brokered Grant Rogan and his Blenheim Capital.In 2010 Blenheim was awarded a $5 billion contract by the Malaysian Government to manage ALL of its defence off-set deals. Blenheim has close ties with the UK's Ministry of Defence,which together with the UK's arms industry would the be principal beneficiary of his deals (see references below).

However, by April 2016 Blenheim appeared to have given up on that business and was instead working with the Malaysian Government to finance, build and operate two military communications satellites. The signing of the deals was witnessed by DPM Zahid Hamidi, and roughly coincided with anews that Malaysia had already decided on acquiring French made Rafale jets instead of the Typhoons.

The main thing that has changed between then and now is the US DOJ's seizure of assets acquired with funds stolen from 1MDB,which include a multi-million dollar apartment in the UK held in the name of Riza Aziz. Despite that early involvement in the US action, UK authorities have done nothing with regards prosecution.

END

REFERENCES

Born in 1955. British

Chief executive of Blenheim Capital

Chief executive of Blenheim Capital since its foundation in 2006, Grant Rogan has been active in the Gulf since the 1980s. His father, Richard Grant Rogan, was already a connoisseur of the region. Middle East director of Northrop Grumman in the 1970s, he was a regular contact of Adnan Khashoggi, the famous Saudi arms dealer. His son, Grant, quickly opted to specialise in the discreet offset sector and set up his first consultancy company, Summit Group.

Offsets, which were originally intended to encourage the development of local industry in the Gulf, have become a determining factor in the signature of major contracts, particularly in the defence sector. From being a sideline, they have become a central feature in contract negotiations. One of the reasons for their success is that they are not totally covered by the transparency criteria governing commission payments which were brought into force by OECD convention in 1997.

Offsets are set up directly by the companies concerned, notably by their head office financial staff. But many companies opt to farm out the process and call in specialised operators. Over more than 20 years, Grant Rogan has become one of the leaders in this market. If he is called in, it is also because he is able to serve as an intermediary between Western defence groups and local offset bureaux. He is someone Western defence groups looking to carry out major projects in the region need to talk to but also someone who has precious contacts with the states of the region and their offset bureaux, which he advises and sometimes audits.

Blenheim Capital, which was the first offset company to receive certification from Britain’s Financial Services Authority (FSA) in 2010, has offices in London, Abu Dhabi and Washington and has extended the geographical range of activity to the Far East, principally Malaysia.

DSA 2016: BAE Systems outlines Typhoon offset package for Malaysia

Jon Grevatt, Bangkok - IHS Jane's Defence Weekly

18 April 2016